Making Tax Digital: The New Reality of Quarterly Submissions and Heavy Fines

The landscape for UK sole traders and landlords is about to undergo its most significant change in decades. Starting in April 2026, the government is rolling out Making Tax Digital (MTD) for Income Tax, a system that replaces the traditional annual tax return with a high-frequency reporting cycle.

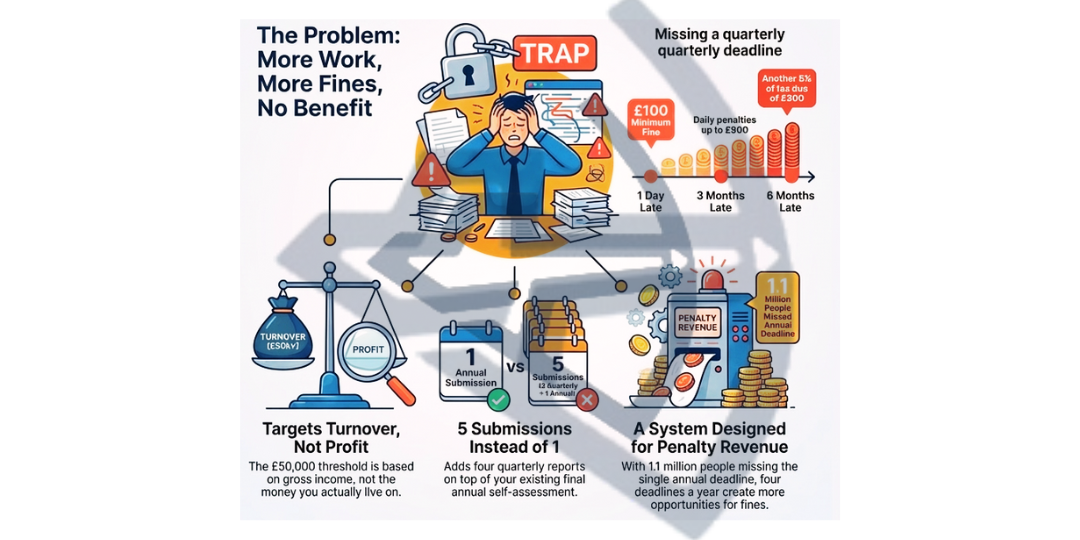

While the government frames this as “digital transformation,” the reality for many small businesses is a significant increase in administrative burden and a high risk of automated fines

Currently, sole traders benefit from a flexible model where they can manage their records in a way that works for them, filing one self-assessment return per year. MTD fundamentally dismantles this flexibility

Under the new rules, if your Turnover is over £50,000, you are being asked to:

• Maintain digital records of all income and expenses.

• Submit four quarterly reports through MTD-compatible software.

• File these reports by the 7th of the month following the end of each quarter.

• Complete a final self-assessment at the end of the year to finalize adjustments and reliefs

THE FINES

The penalty structure is rigid and “stacks up” quickly:

• One day late: An immediate £100 minimum penalty.

• Three months late: Daily penalties of £10, reaching up to £900.

• Six months late: An additional 5% of the tax due or £300, whichever is greater.

Crucially, these are “admin failure” fines. They apply even if you have made zero profit, owe no tax, or are well under your personal tax allowance

If you are concerned how you will manage MTD speak to Archers Accountants your ‘straight talking advisors’.