Missing HMRC deadlines can be costly. Late submission penalties apply to tax returns, VAT returns, payroll filings, and statutory accounts, and the financial impact can escalate quickly. For individuals and businesses alike, understanding these penalties—and avoiding them—is essential.

What Are HMRC Late Submission Penalties?

HMRC imposes penalties when required returns or documents are submitted after the statutory deadline. Common examples include:

- Self Assessment tax returns – An automatic £100 penalty applies immediately after the deadline, even if no tax is due. Further daily penalties, six-month penalties, and twelve-month penalties can follow.

- Corporation Tax returns – Late filing can result in fixed penalties, with higher penalties for repeated delays.

- VAT returns – Under the VAT penalty system, late submissions and late payments can trigger points, financial penalties, and interest.

- PAYE and payroll filings – Late or inaccurate submissions can lead to penalties for each missed or incorrect return.

In addition to financial penalties, late submissions often attract increased HMRC scrutiny, compliance checks, and unnecessary stress.

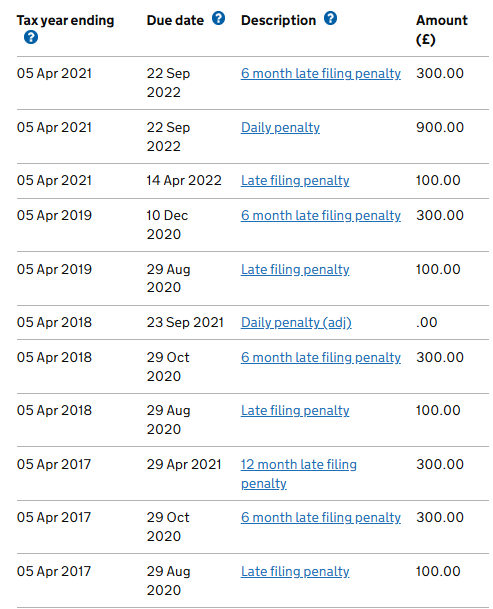

DO NOT let your Personal Gateway Account with HMRC look like this

We have helped clients like this to resolve matters with HMRC

Peace of Mind and Long-Term Compliance

Engaging an accountant is not just about avoiding penalties; it is about gaining peace of mind. Knowing that your obligations are being managed professionally allows you to focus on running your business or managing your personal finances, confident that compliance is under control.

If you are concerned about HMRC deadlines or have already received a late submission penalty, professional advice can make a significant difference. Early action is often the key to minimising costs and resolving issues efficiently.

If you are want to remain compliant speak to Archers Accountants your ‘straight talking advisors’.